TRADE THE LONDON SESSION WITH STRUCTURE

I trade NASDAQ (NQ) and S&P 500 (ES) using repeatable rules — not hype.

I trade NASDAQ (NQ) and S&P 500 (ES) using repeatable rules — not hype.

Most traders fail because they don't have structure. They chase setups, stack indicators, and hope for the best.

This approach is different. Session-based structure, clear daily bias, and liquidity targets that price actually reacts to.

My trading is built around session structure, daily bias, and liquidity — not random entries or stacked indicators.

Inside the Discord, I break down how this framework is applied in real time during London and New York.

Premium tools and advanced resources are available inside the Discord.

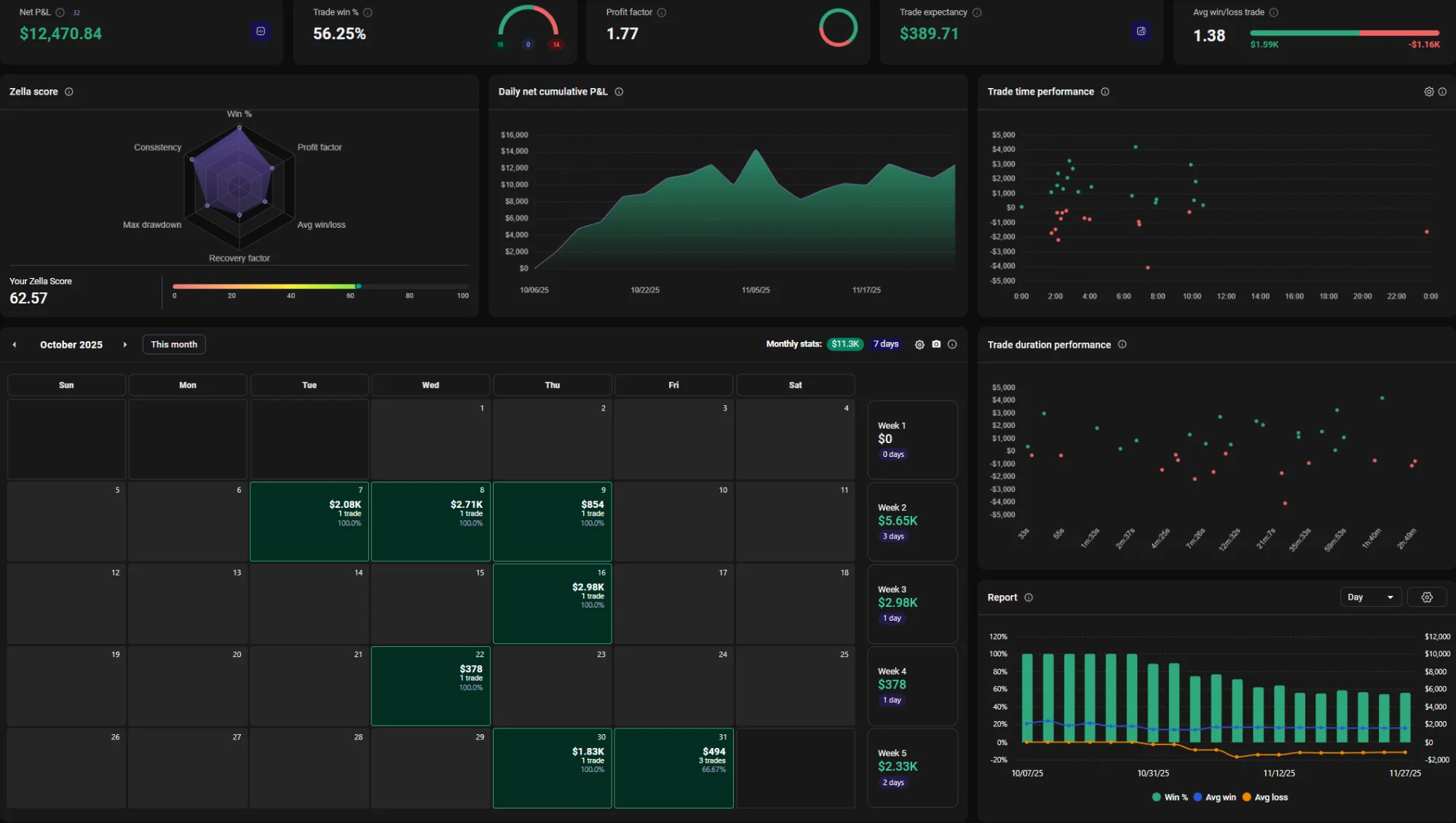

I've built my approach around full transparency, data, and repeatability — not hype. My edge comes from session-based liquidity sweeps in London and New York, focusing on 2AM, 6AM, and 10AM (NY) four-hour candle alignments, combining ICT concepts, FVGs, market structure shifts, and algorithmic liquidity levels.

Inside my mentorship, you get access to the exact TradeZella playbooks I use to refine risk-to-reward, track session behaviour, and identify where your edge actually lives. No signal chasing. No guesswork. Just a clean, disciplined framework built around liquidity, timing, and execution.

Whether you're new to ICT or sharpening an existing playbook, I show you precisely how I trade — from weekly narrative to session setups to the metrics that keep you consistent. Clear. Structured. Built for long-term growth.

No. The free community is designed to introduce you to the framework, regardless of your experience level.

No. Many members learn on funded accounts or prop firms, which removes the need for personal capital.

Yes. The framework is designed to work within prop firm rules and evaluation requirements.

Live commentary covers London and New York sessions, typically around 2AM, 6AM, and 10AM NY time.

The Free Community gives you access to basic discussions and resources. The Traders Pod includes live sessions, full course access, and premium tools.

Stop guessing. Start trading with confidence, strategy, and a community that has your back.

Access Full Course & Mentorship